Introduction to Insuring the Uninsurable: How Specialty Insurance Can Save Your Business

Insuring the uninsurable is a daunting task, but with specialty insurance, businesses can protect themselves against unforeseen risks. Insuring the Uninsurable: How Specialty Insurance Can Save Your Business is a crucial aspect of risk management, and in this article, we will delve into the world of specialty insurance and its benefits. As a business owner, it’s essential to understand the importance of protecting your assets, and specialty insurance can provide the necessary coverage for unique and high-risk industries.

In today’s fast-paced business environment, companies face numerous risks that can impact their operations and bottom line. From natural disasters to cyber-attacks, the potential for loss is ever-present. While traditional insurance policies may not provide adequate coverage for certain risks, specialty insurance can fill the gap. By understanding the concept of insuring the uninsurable and the role of specialty insurance, businesses can take proactive steps to mitigate potential losses and ensure their continued success.

Understanding Specialty Insurance and Its Benefits

Specialty insurance is a type of insurance coverage designed for unique and high-risk industries or situations. It provides protection against risks that are not typically covered by traditional insurance policies, such as terrorism, cyber-attacks, or environmental pollution. Specialty insurance policies are often customized to meet the specific needs of a business, taking into account the industry, location, and type of risk. This type of insurance can be particularly beneficial for companies operating in high-risk sectors, such as construction, healthcare, or finance.

The benefits of specialty insurance are numerous. For one, it provides businesses with financial protection against unforeseen events, allowing them to recover quickly and minimize losses. Specialty insurance can also help companies maintain their reputation and credibility, as it demonstrates a commitment to risk management and responsible business practices. Furthermore, having specialty insurance can give businesses a competitive edge, as it shows that they are proactive and willing to invest in their future. With the right specialty insurance policy, companies can enjoy peace of mind, knowing that they are protected against even the most unlikely events.

The Importance of Risk Assessment in Insuring the Uninsurable

Risk assessment is a critical component of insuring the uninsurable. Before purchasing specialty insurance, businesses must conduct a thorough risk assessment to identify potential vulnerabilities and threats. This involves analyzing the company’s operations, industry, and location to determine the likelihood and potential impact of various risks. By understanding the specific risks faced by the business, companies can select the most appropriate specialty insurance policy and ensure that they have adequate coverage.

A comprehensive risk assessment should take into account both internal and external factors. Internal factors may include employee safety, equipment maintenance, and financial stability, while external factors may include natural disasters, regulatory changes, and market fluctuations. By considering these factors, businesses can develop a tailored risk management strategy that includes specialty insurance as a key component. Effective risk assessment can also help companies identify areas for improvement and implement measures to mitigate potential risks, reducing the likelihood of claims and minimizing losses.

Types of Specialty Insurance Policies for Uninsurable Risks

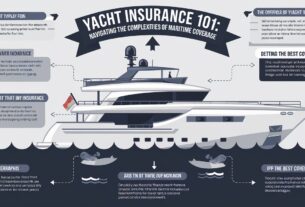

There are various types of specialty insurance policies available to protect businesses against uninsurable risks. One example is cyber insurance, which provides coverage against cyber-attacks, data breaches, and other cyber-related threats. This type of insurance is particularly important for companies that handle sensitive customer data or rely heavily on technology. Another example is environmental insurance, which covers businesses against pollution, contamination, and other environmental hazards. This type of insurance is essential for companies operating in industries such as manufacturing, construction, or agriculture.

Other types of specialty insurance policies include terrorism insurance, which provides coverage against terrorist attacks, and kidnap and ransom insurance, which protects against kidnapping and extortion. There is also intellectual property insurance, which covers businesses against intellectual property theft, patent infringement, and other IP-related risks. Additionally, companies can purchase supply chain insurance, which provides protection against disruptions to the supply chain, such as natural disasters or supplier insolvency. By selecting the right specialty insurance policy, businesses can ensure that they have comprehensive coverage against a range of uninsurable risks.

How Specialty Insurance Can Save Your Business

Specialty insurance can save your business in several ways. Firstly, it provides financial protection against unforeseen events, allowing companies to recover quickly and minimize losses. This can be particularly important for small or medium-sized businesses, which may not have the financial resources to absorb significant losses. Secondly, specialty insurance can help businesses maintain their reputation and credibility, as it demonstrates a commitment to risk management and responsible business practices.

Thirdly, specialty insurance can give companies a competitive edge, as it shows that they are proactive and willing to invest in their future. By having the right specialty insurance policy, businesses can reduce their risk profile and attract investors, customers, and partners. This can lead to increased revenue, growth, and profitability. Furthermore, specialty insurance can provide businesses with access to expert advice and risk management services, helping them to identify and mitigate potential risks. By working with a specialty insurance provider, companies can develop a comprehensive risk management strategy that includes insurance, risk assessment, and mitigation.

Best Practices for Purchasing Specialty Insurance

When purchasing specialty insurance, there are several best practices to keep in mind. Firstly, businesses should work with a reputable and experienced insurance broker or provider who has expertise in specialty insurance. This will ensure that the company receives tailored advice and guidance on selecting the right policy. Secondly, companies should conduct a thorough risk assessment to identify potential vulnerabilities and threats, and select a policy that addresses these risks.

Thirdly, businesses should carefully review the policy terms and conditions, ensuring that they understand what is covered and what is not. It’s also essential to consider the policy’s limit of liability, deductible, and premium, and to ensure that the policy is affordable and aligned with the company’s budget. Additionally, companies should establish a strong relationship with their insurance provider, as this can facilitate claims handling and ensure that the business receives the support it needs in the event of a loss. By following these best practices, businesses can ensure that they purchase the right specialty insurance policy and maximize their protection against uninsurable risks.

Conclusion and Future Outlook for Insuring the Uninsurable

In conclusion, insuring the uninsurable is a critical aspect of risk management, and specialty insurance can provide the necessary coverage for unique and high-risk industries. By understanding the concept of insuring the uninsurable and the role of specialty insurance, businesses can take proactive steps to mitigate potential losses and ensure their continued success. As the business environment continues to evolve, the demand for specialty insurance is likely to grow, driven by emerging risks such as cyber threats, climate change, and global uncertainty.

In the future, we can expect to see increased innovation in the specialty insurance market, with new products and services being developed to address emerging risks. Additionally, there will be a greater focus on risk management and mitigation, with businesses working closely with insurance providers to identify and address potential vulnerabilities. By investing in specialty insurance and adopting a proactive approach to risk management, companies can protect themselves against uninsurable risks and achieve long-term success. With the right specialty insurance policy, businesses can navigate the complexities of the modern business environment and thrive in an increasingly uncertain world.