Introduction to the often-overlooked aspects of home insurance policies is crucial for homeowners. Understanding what is covered and what is not can help prevent financial burdens in the face of unexpected events. “10 Things Your Home Insurance Policy Might Not Cover” is a critical piece of information every homeowner should be aware of to ensure they have the right protection for their properties.

Home insurance policies are designed to provide financial protection against damage to a home and its contents. However, these policies do not cover everything, and there are specific exclusions and limitations that homeowners should be aware of. From natural disasters to personal liability, the coverage of home insurance can vary widely. It is essential to review and understand the terms of the policy to avoid any surprises when making a claim. Homeowners need to recognize that while home insurance provides a broad range of coverage, there are indeed things that it might not cover, and being informed is the first step to adequate protection.

The specifics of what is covered can vary significantly from one policy to another, making it imperative for homeowners to carefully read through their policy documents. Exclusions and limitations can include anything from maintenance-related damages to acts of war, and it’s crucial to understand these specifics to ensure the homeowner is adequately protected. Furthermore, additional coverage options might be available to fill gaps in the standard policy, offering homeowners a way to customize their insurance to better fit their needs.

Understanding Home Insurance Exclusions

Home insurance exclusions are clauses within the policy that specify what is not covered. These can range from damage caused by maintenance neglect to intentional acts by the homeowner. Understanding these exclusions is crucial because it helps homeowners manage their expectations and plan for risks that are not covered. For example, most standard home insurance policies do not cover flood damage, which can be a significant concern for homeowners in flood-prone areas. Knowing about these exclusions can prompt homeowners to seek out additional coverage options, such as flood insurance, which can provide financial protection in the event of a flood.

The process of identifying and addressing potential gaps in coverage starts with a thorough review of the policy. Homeowners should look for sections that outline exclusions and limitations, taking note of any specific risks that are not covered. It is also beneficial to consult with an insurance professional who can provide guidance on the policy’s terms and help identify additional coverage needs. This proactive approach can help homeowners avoid the financial strain of uncovered losses and ensure they have the protection they need in case of unexpected events.

Common Home Insurance Gaps in Coverage

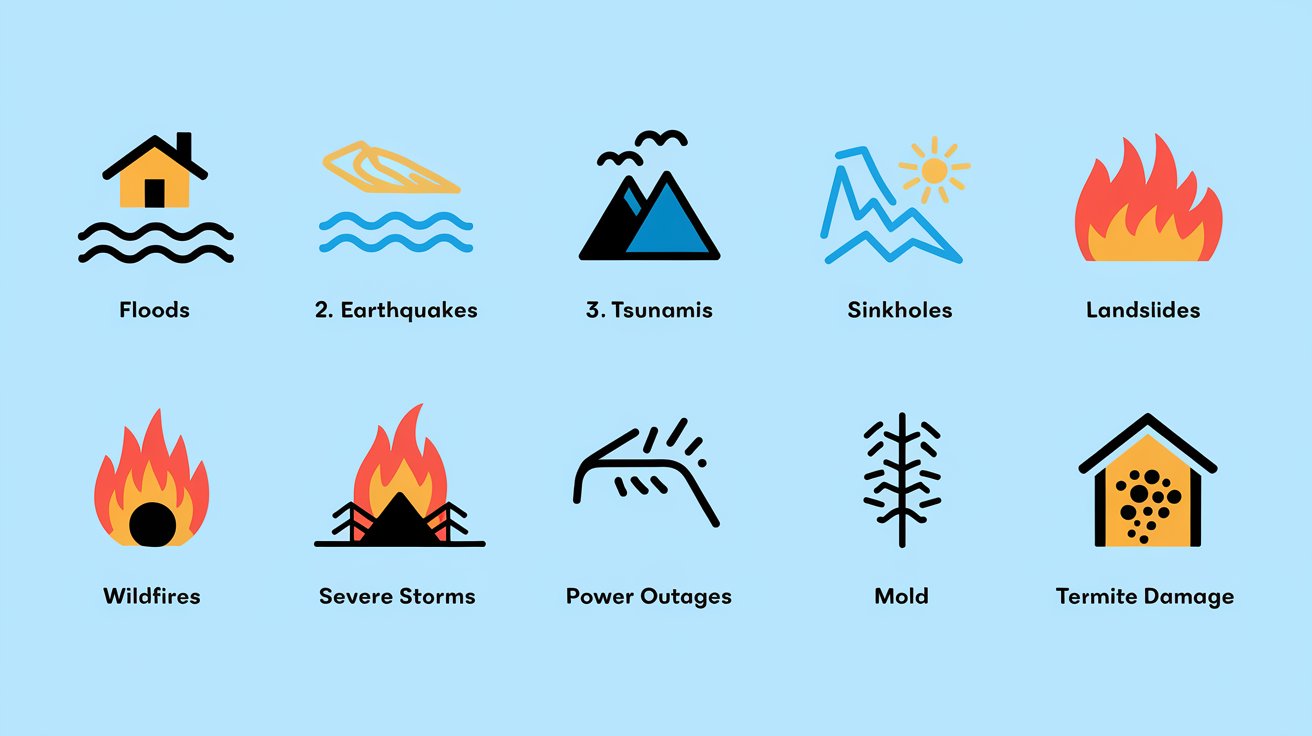

One of the most significant gaps in home insurance coverage is related to natural disasters. While policies may cover some types of natural disasters, such as windstorms or hail, others like earthquakes or floods often require separate policies. Homeowners in areas prone to these types of disasters need to be particularly aware of these gaps and take steps to secure additional coverage. This not only protects the home itself but also its contents and can help with temporary housing should the damage be severe enough to require relocation.

Another common gap is related to personal liability. Standard home insurance policies typically include some level of liability coverage, which protects the homeowner if someone is injured on their property. However, the limits of this coverage can be quickly exceeded in the event of a serious injury, leaving the homeowner financially vulnerable. Increasing liability coverage or purchasing an umbrella policy can help mitigate this risk, providing an additional layer of financial protection.

Home insurance policies also often have limitations on coverage for certain types of personal property. For instance, items like jewelry, artwork, or collectibles might only be covered up to a certain amount unless specifically listed and appraised within the policy. Homeowners with valuable items need to understand these limitations to ensure their possessions are adequately covered. This might involve scheduling these items on the policy, which can provide higher limits for these specific pieces.

Navigating Policy Limitations and Deductibles

Policy limitations and deductibles are critical components of home insurance that can significantly impact the homeowner’s financial situation in the event of a claim. Limitations refer to the maximum amount the insurance company will pay out for a specific type of loss, while deductibles are the amounts the homeowner must pay out of pocket before the insurance coverage kicks in. Understanding these aspects of the policy can help homeowners plan and budget for potential risks and ensure they have the financial resources needed to cover their share of the costs.

Navigating these policy details requires careful consideration of the homeowner’s financial situation and risk tolerance. For example, choosing a policy with a higher deductible might lower the premium cost but would require the homeowner to have sufficient funds available to cover the deductible in the event of a claim. Conversely, opting for a lower deductible might increase the premium but would reduce the out-of-pocket expenses when making a claim. This balance between premium cost and deductible amount is a key decision that homeowners must make based on their individual circumstances and financial preparedness.

Moreover, policy limitations can sometimes be increased with additional coverage options. For instance, if a policy has a limitation on coverage for certain types of personal property, homeowners can often purchase additional coverage, such as a rider for jewelry or artwork, to increase the protection for these items. This customizable approach to insurance allows homeowners to tailor their policy to their specific needs, ensuring they have adequate coverage for their valuables.

The Importance of Policy Reviews and Updates

Regular reviews and updates of home insurance policies are essential for ensuring that the coverage remains adequate and relevant to the homeowner’s current situation. Over time, changes in the home’s value, the acquisition of new personal property, or shifts in local risk factors (such as an increase in crime rates or the discovery of nearby environmental hazards) can all impact the sufficiency of the insurance coverage. A periodic review can help identify any gaps or inadequacies in the policy, allowing the homeowner to make necessary adjustments.

The process of reviewing and updating a home insurance policy should be systematic and thorough. Homeowners should start by re-assessing the value of their home and its contents to ensure the policy limits are sufficient. They should also consider any changes in their personal circumstances, such as an increase in income or the acquisition of valuable items, which might affect their insurance needs. Furthermore, staying informed about local conditions and potential risks can help homeowners anticipate and prepare for possible gaps in coverage.

Additionally, policy reviews provide an opportunity for homeowners to explore discounts or savings opportunities. Many insurance companies offer discounts for factors such as home security systems, non-smoker status, or bundling multiple policies. Identifying and taking advantage of these discounts can help reduce the cost of insurance without compromising on coverage. This proactive management of the insurance policy not only ensures the homeowner has the protection they need but also helps in optimizing the cost of that protection.

Customizing Home Insurance for Specific Needs

Home insurance can be customized to meet the specific needs of the homeowner. This can involve adding endorsements or riders to the policy to increase coverage for particular items or risks. For example, a homeowner with a valuable collection might add a rider to their policy to ensure this collection is fully covered in the event of loss or damage. Similarly, homeowners in high-risk areas might opt for additional coverage for floods, earthquakes, or other natural disasters not covered by the standard policy.

The customization of home insurance requires a deep understanding of the homeowner’s specific situation and risk profile. It involves identifying what is not covered by the standard policy and then seeking out additional coverage options to fill these gaps. This might include working closely with an insurance agent who can provide guidance on the available options and help tailor the policy to the homeowner’s unique needs. The goal is to create a comprehensive insurance package that provides complete financial protection against potential risks and losses.

Furthermore, technological advancements have made it easier for homeowners to customize their insurance coverage. Many insurance companies now offer online platforms where homeowners can adjust their policy details, add coverage, or even purchase new policies tailored to their specific needs. This accessibility and flexibility in insurance management empower homeowners to take a more active role in managing their risk and ensuring they have the right level of protection for their home and valuables.

Conclusion on Home Insurance Coverage Gaps

In conclusion, while home insurance provides vital financial protection for homeowners, there are indeed gaps in coverage that every homeowner should be aware of. From exclusions and limitations to the need for additional coverage options, understanding what is covered and what is not is essential for making informed decisions about insurance. Regular policy reviews, customization of coverage, and a proactive approach to risk management can all help ensure that homeowners have the protection they need without unexpected surprises.

Homeowners must approach home insurance with a comprehensive understanding of their risks and the coverage options available to them. This involves not just purchasing a policy but also regularly reviewing and updating it to reflect any changes in their situation or risk profile. By doing so, homeowners can navigate the complexities of home insurance with confidence, knowing they have taken all necessary steps to protect their home and financial well-being. The key to effective home insurance is knowledge and proactive management, ensuring that the policy serves as a strong foundation for the homeowner’s overall financial security strategy.

Ultimately, the goal of home insurance is to provide peace of mind and financial protection. Achieving this goal requires a detailed understanding of the policy, its limitations, and the additional coverage options available. As the housing market and insurance landscape continue to evolve, homeowners must stay informed and adapt their insurance strategies accordingly. By doing so, they can ensure they have the right protection for their home, now and in the future, and can face the challenges of homeownership with confidence and security.