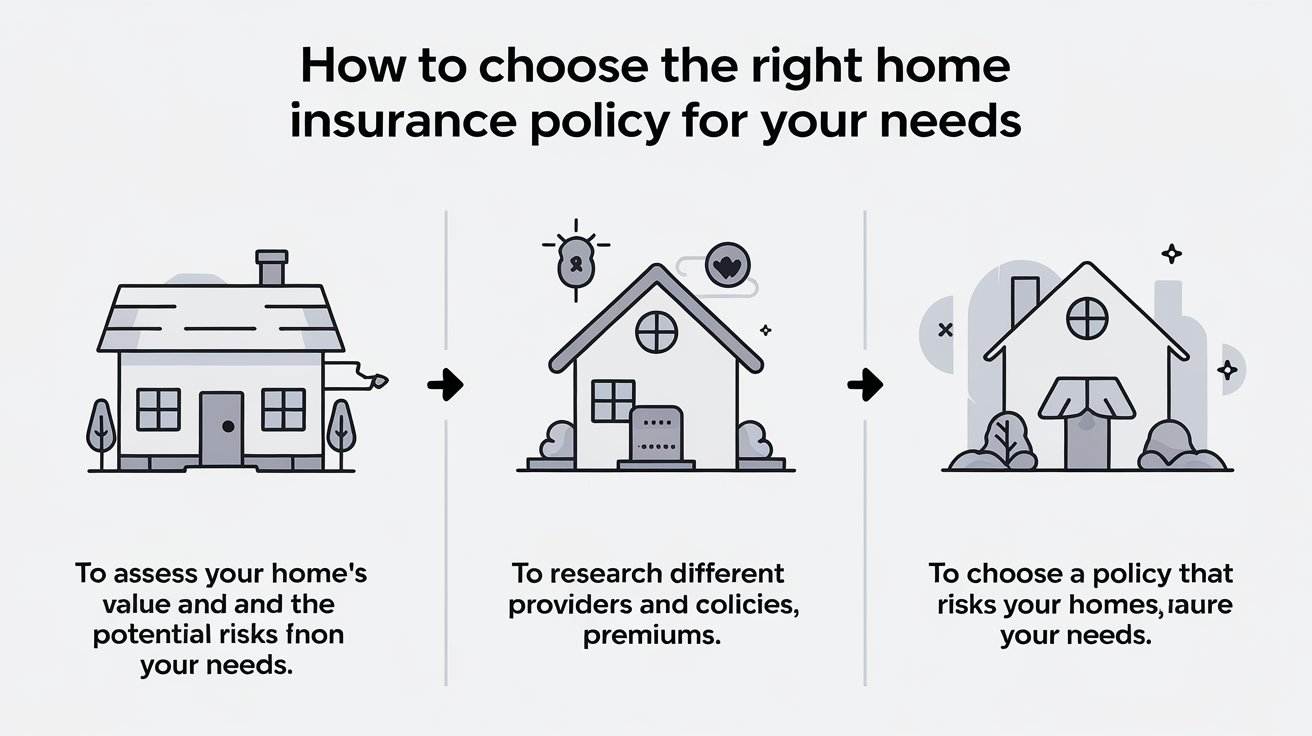

Introduction to Choosing the Right Home Insurance Policy

When it comes to protecting your most valuable asset, your home, having the right insurance policy is crucial. Learning How to Choose the Right Home Insurance Policy for Your Needs can be a daunting task, but with the right guidance, you can make an informed decision. In this comprehensive guide, we will walk you through the process of selecting the perfect home insurance policy that suits your unique needs and budget.

The process of choosing a home insurance policy involves more than just comparing quotes from different insurers. It requires a thorough understanding of what you need to protect, the types of coverage available, and how to customize a policy to fit your lifestyle. With so many options available, it’s essential to take the time to research and understand your options. This will ensure that you have adequate protection against unforeseen events, such as natural disasters, theft, or accidents, which can cause significant financial strain.

Understanding Home Insurance Basics

Understanding the basics of home insurance is the first step in choosing the right policy. Home insurance, also known as homeowners insurance, is a type of property insurance that covers a private residence. It provides financial protection against damages to the home and its contents, as well as liability for accidents that may occur on the property. A standard home insurance policy typically includes coverage for the dwelling, other structures, personal property, loss of use, and personal liability.

The dwelling coverage protects the physical structure of the home, including the foundation, walls, roof, and any attached structures like a garage. Other structures coverage includes detached structures like a shed or fence. Personal property coverage protects the contents of the home, such as furniture, appliances, and clothing. Loss of use coverage provides financial assistance if the home is uninhabitable due to damage, and personal liability coverage protects the homeowner in case of accidents on the property.

Assessing Your Home Insurance Needs

Assessing your home insurance needs is a critical step in the process of choosing the right policy. To determine what type of coverage you need, you should consider several factors, including the value of your home and its contents, the location of your home, and your personal financial situation. You should also consider any specific risks or hazards associated with your home, such as a history of natural disasters or a high crime rate in the area.

When assessing your home insurance needs, it’s essential to make a thorough inventory of your possessions and their values. This will help you determine how much coverage you need for personal property. You should also consider the cost of rebuilding your home if it’s destroyed, which may be different from its market value. Additionally, you should think about any additional coverage options you may need, such as flood insurance or earthquake insurance, depending on your location.

Types of Home Insurance Policies

There are several types of home insurance policies available, each with its unique features and benefits. The most common types of policies include HO-1, HO-2, HO-3, and HO-5. HO-1 is a basic policy that provides limited coverage for the home and its contents. HO-2 provides more comprehensive coverage, including protection against theft and vandalism. HO-3 is the most common type of policy and provides broad coverage for the home and its contents, including protection against most perils.

HO-5 is a premium policy that provides the most comprehensive coverage available, including protection against all perils, except those specifically excluded. It’s essential to understand the differences between these policies and choose the one that best fits your needs. You should also consider additional coverage options, such as flood insurance, earthquake insurance, and umbrella insurance, which can provide extra protection against specific risks.

How to Choose the Right Home Insurance Company

Choosing the right home insurance company is just as important as choosing the right policy. With so many insurance companies available, it can be challenging to know which one to choose. When selecting a home insurance company, you should consider several factors, including the company’s financial stability, customer service reputation, and claims handling process. You should also compare rates and coverage options from different companies to ensure you’re getting the best value for your money.

It’s essential to research the company’s reputation and read reviews from current and former customers. You should also check the company’s financial stability by reviewing its ratings from independent rating agencies, such as A.M. Best or Moody’s. Additionally, you should consider the company’s claims handling process and ensure that it has a 24/7 claims hotline and a straightforward claims process.

Customizing Your Home Insurance Policy

Customizing your home insurance policy to fit your unique needs is crucial. Most insurance companies offer a range of optional coverage and discounts that can help you tailor your policy to your lifestyle. For example, you may want to add coverage for specific items, such as jewelry or fine art, or add a rider for a home-based business. You should also consider discounts, such as a bundling discount for combining multiple policies or a discount for installing security systems.

When customizing your policy, it’s essential to work with an experienced insurance agent who can help you navigate the process. They can help you identify areas where you may need additional coverage and ensure that you’re taking advantage of all available discounts. Additionally, you should review your policy regularly to ensure that it still meets your needs and make adjustments as necessary.

Conclusion and Final Tips

Choosing the right home insurance policy requires careful consideration and research. By understanding the basics of home insurance, assessing your needs, and customizing your policy, you can ensure that you have adequate protection against unforeseen events. Remember to choose a reputable insurance company, compare rates and coverage options, and take advantage of available discounts. Finally, review your policy regularly to ensure that it still meets your needs and make adjustments as necessary. By following these tips, you can have peace of mind knowing that your home and its contents are protected.